In August, Canadian ETFs experienced an inflow of $2.9B, similar to the $3.1B inflow from last month. Fixed-income ETFs continued to be the favored choice among investors, contributing a substantial $2.6B to the overall monthly total of $2.9B.

Over the first eight months of the year, Canadian ETFs gathered a total of $25.3B in assets. Fixed-income ETFs took the lead with $15.4B in investments, followed by equity with $7.8B in inflow, indicating a strong and diversified appetite among investors in the Canadian ETF market.

The Horizons US 7-10 Year Treasury Bond ETF (HTB-T) secured the top position among all ETFs, collecting $0.8B in inflow suggesting duration exposure. A slight shift from the previous months where aggregate bond ETFs were a popular choice in combination with money market ETFs.

The iShares S&P/TSX 60 Index ETF (XIU-T) secured the second place with an inflow of $0.5B while the CI First Asset High Interest Savings ETF (CSAV-T) and Horizons High Interest Savings ETFs (CASH-T) attracted a combined $0.6B in investments and were the third and fifth most popular ETFs.

The iShares ESG Aware MSCI Emerging Markets Index (XSEM-T) was not the most popular ETF in August, unlike the previous two months, but dropped at the fourth place with an inflow of $0.3B. This suggests that investors continue to appreciate the ETF’s investment thesis, but invest somewhat more conservatively in the strategy.

Despite its robust 7.2 per cent monthly gain, the iShares S&P/TSX Capped Energy Index ETF (XEG-T) experienced a significant outflow of $0.5B. The positive performance was driven by a substantial uptick in WTI crude oil prices, which surged from US$70.64 at the end of June to US$83.63 at the end of August. The ETF returned a cumulative 263.2 per cent or 53.7 per cent annualized return over the last 3 years. Investors likely have taken profits after this short-term and 3-year bull run.

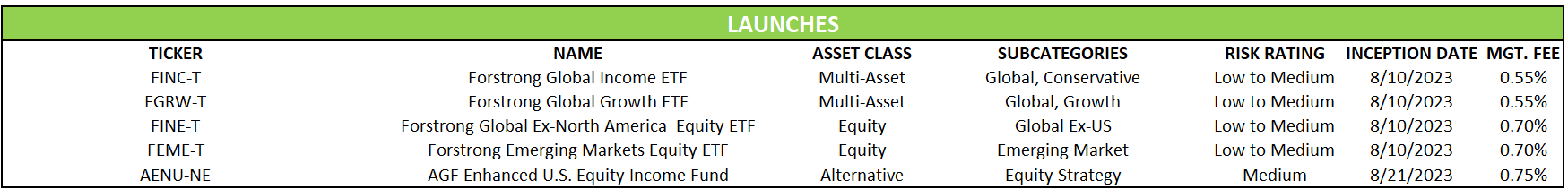

Additions to our database

Forstrong Global Asset Management, a global macroeconomic investment manager, begins its journey into the Canadian market as an ETF provider with the launch of four new ETFs.

Forstrong Global Income ETF (FINC-T) and Forstrong Global Growth ETF (FGRW-T) use an active, top-down multi-asset approach to portfolio construction and management across global risk factors. FINC-T prioritizes income-oriented investments, allocating approximately 70 per cent of its portfolio to fixed income and cash equivalents at the moment. In contrast, FGRW-T currently maintains a fixed income and cash equivalents exposure of around 15 per cent.

The Forstrong Emerging Markets Equity ETF (FEME-T) and the Forstrong Global Ex-North America Equity ETF (FINE-T) employ an active approach for selecting countries, sectors, and themes to target equity exposure in emerging markets and North America, respectively.

AGF launched the AGF Enhanced U.S. Equity Income Fund (AENU-NE), an ETF series of an existing mutual fund. The strategy seeks dividend-paying U.S. equity securities while mitigating volatility and generating consistent income through the use of both covered calls and covered puts.

Anthony Ménard, CFA, is vice-president of data management at Inovestor.

At Inovestor, we believe that investors deserve access to the best financial information available. Leveraging our suite of award-winning research technologies, we go above and beyond to put that information at your fingertips. For more information, please visit inovestor.com