Number Cruncher Extra – The North West Company (NWC:TSX), Torex Gold Resources Inc (TXG:TSX), & Telus International Inc. (TIXT:TSX)

In our last Number Cruncher we discussed how The North West Company Inc (NWC:TSX), Torex Gold Resources Inc (TXG:TSX), & Telus International Inc. (TIXT:TSX) are companies that leverage their free cash flow to generate value and growth.

Let’s Begin with NWC

NWC has an SP Score of 76, up by 3 points in the past 90 days. This is derived by using the Performance score of 75.7 and the Risk score of 23.3. The company is a defensive stock and has been able to maintain its 5Y sales growth average to about 4.2%. However, it saw a 20.4% decline in its EPS last year.

The company’s good performance has kept its intrinsic value above the market price since July 2018, peaking in the year 2020 which was an exceptionally strong year for the company majorly because of the lockdowns. The company’s value has been in decline since then, stabilizing in the last quarter and increasing a little. Contrarily, the company is still undervalued with an intrinsic value $71.98 with market price currently trading at $38.6. As per our calculations of the intrinsic value the company’s price could be approximately 86.6% undervalued

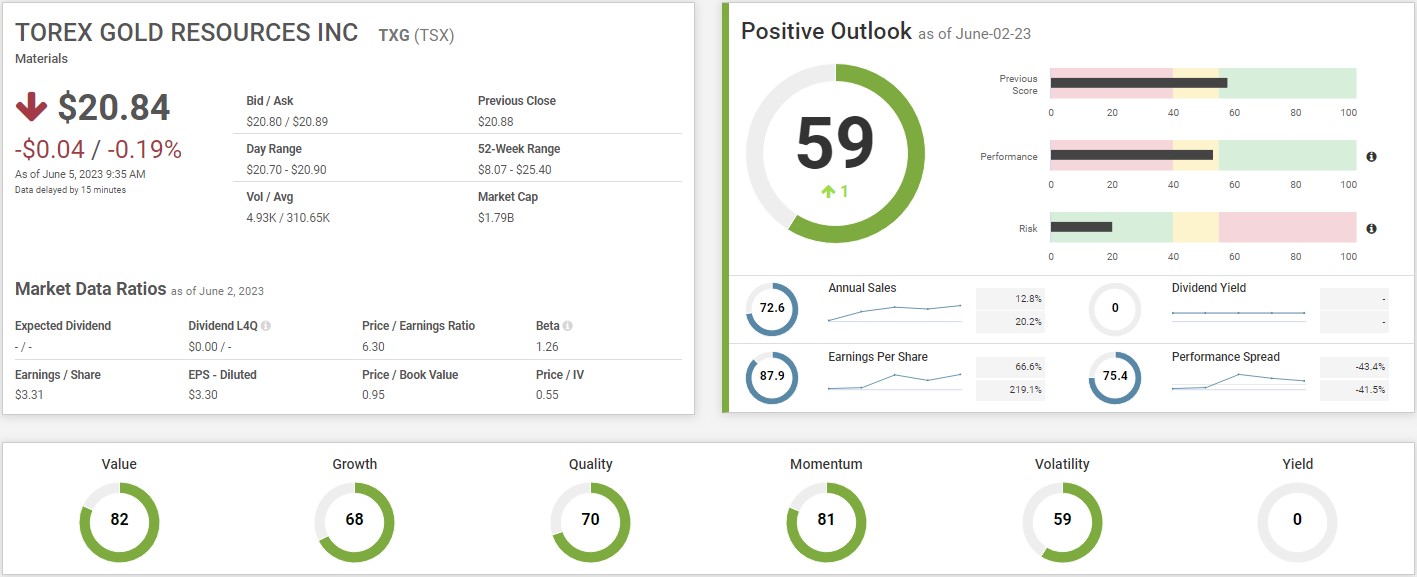

TXG has an SP score of 59, increased by 1 point (Performance score: 53.3 & Risk score: 20.3) in the past 90 days. The company has scored a Value score of 82, a quality score of 70 and the growth score of 68. The company has been able to maintain an average 5Y earnings per share growth of 219.1%, and the 1 Y growth is 66.6%. Last year, the company saw an increase of about 12.8% in revenues.

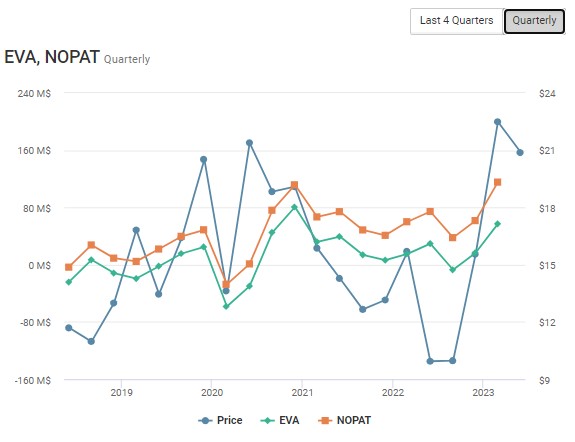

Our quarterly EVA, NOPAT chart shows the company’s economic performance improving. In the last two quarters, we note the uptrend in the Net operating profit after tax thereby increasing its economic value added. The EVA has grown about 584.8% and NOPAT about 413.2% in the past 3 years.

The earnings are an essential factor in determining a company’s intrinsic value, which we estimate to be 82.5% undervalued.

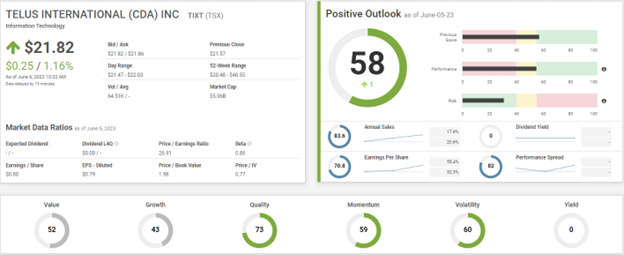

Telus International Inc.’s SP score increased by 1 point, increasing it to 58 within the last quarter. The company’s sales increased by 17.9% and showed a significant EPS growth of about 55.4% last year. The company has been able to maintain its 5Y average growth rate of about 32.3%.

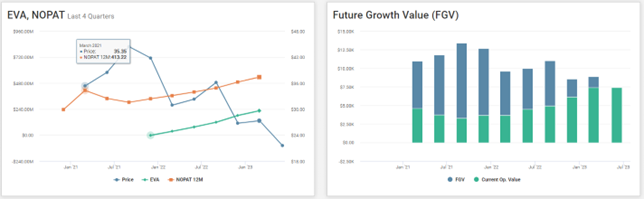

The company has been able to increase its NOPAT consistently for the past six quarters. The company’s Future growth value has been positive for last two years with its current operating value in an uptrend. According to the FGV histogram graph, the company’s operating value has caught up to intrinsic value.

If you have any questions about the article, feel free to contact Anthony :

amenard@inovestor.com

If you would like to sign up for a free trial and learn how Inovestor can benefit you, contact Ramzi:

rkahale@inovestor.com